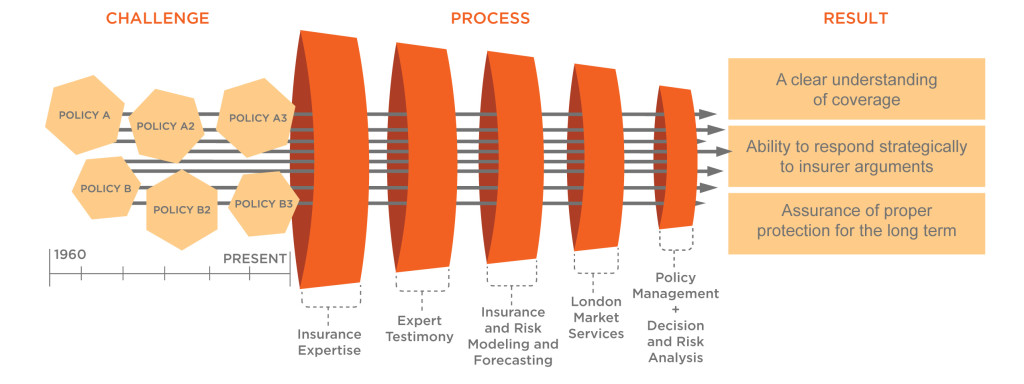

In a typical insurance dispute, there may be numerous disputed issues between the policyholder and the insurer. When pursuing a resolution, compromises often must be made.

What if you could put a number to the issues that really drive the recovery from a policy or an insurer … as well as those that don’t? You would gain clarity about your best strategies, and you would be able to answer some important questions:

– What are your biggest litigation risks?

– What issues should you be willing to compromise?

– What issues can you not afford to compromise?

– What is the overall impact of compromising (or losing in litigation) on two (or more) issues?

Insurance allocation and other types of valuation modeling can provide clear answers to these questions. They help policyholders and their counsel make sense of complex insurance disputes.

For example, one might assume that certain factors always benefit a policyholder, such as a continuous trigger, defense costs paid in addition to limits, and multiple occurrences. It then follows that these issues should always be defended vigorously on principle. However, that strategy may not always be prudent.

With valuation modeling, you can analyze the individual and combined effects of each issue in a dispute. Likewise, valuation modeling can isolate the biggest risks in litigation in order to focus the case strategy and inform counsel where limited resources are best spent. You can also use valuation modeling to inform key stakeholders of the company’s risks and sensitivities to certain settlement and litigation outcomes.

Valuation modeling often reveals surprising results and key insights. Armed with hard data, you can confidently pursue strategies to maximize insurance recovery, all the while giving management the tools it needs to act quickly and decisively.

Have you used valuation modeling to help you prioritize litigation and settlement strategies or gain insights into a complicated dispute? If so, how has it been helpful? Please, share your comments.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas